Los Reyes

Our 100% owned Los Reyes Property is an advanced development-stage project measuring over 6,270 hectares within the prolific Sierra Madre mining belt in Sinaloa, Mexico. Located in the Guadalupe De Los Reyes mining district, the property contains several historic workings with mining dating back to the 1700s. The property is located approximately 45 km southeast of Cosalá , a mining-friendly city. Los Reyes was acquired through the acquisition of Prime Mining in October 2025.

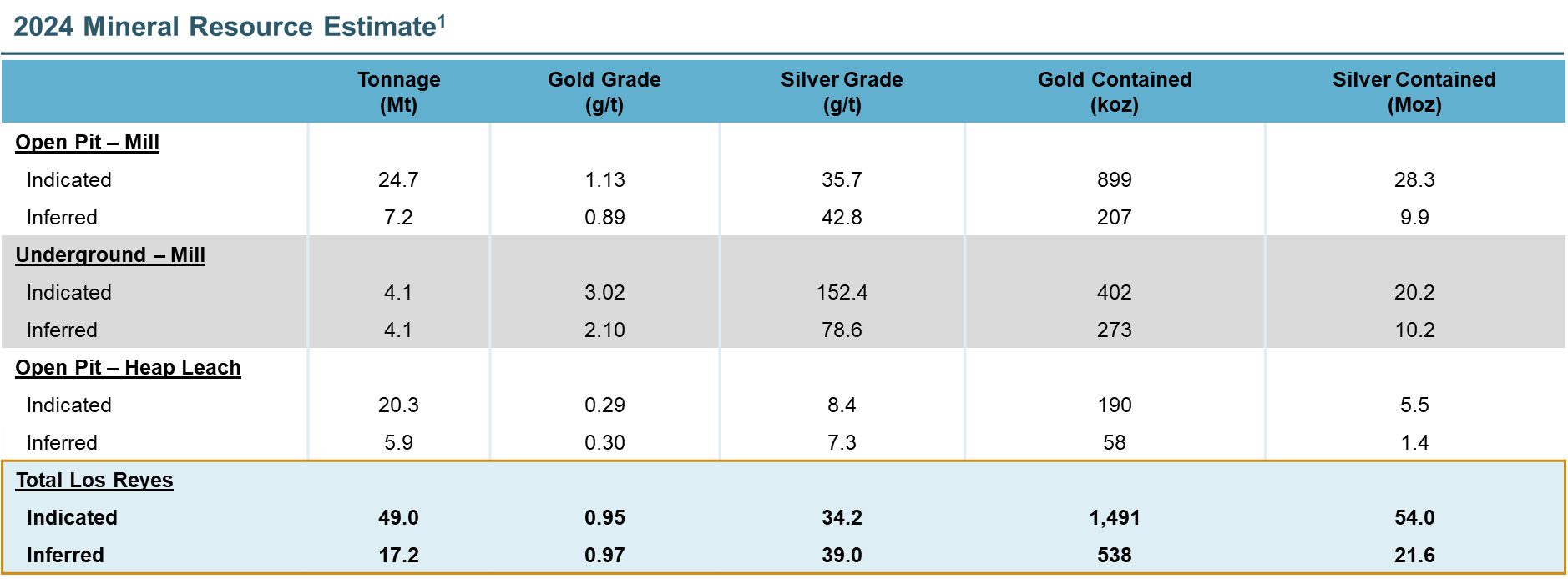

Los Reyes is a low-sulphidation, epithermal gold-silver deposit that could be mineable from a combination of open pit and underground and currently hosts an Indicated Resources of 1.5 million ounces of gold and 54.0 million ounces of silver, as well as an Inferred Resources of 538 thousand ounces of gold and 21.6 million ounces of silver. Excluding low grade heap leach material, Los Reyes contains an Indicated Resource of 1.3 million ounces of gold and 48.5 million ounces of silver, as well as an Inferred Resource of 480 thousand ounces of gold and 20.2 million ounces of silver.

-

Notes

- Prime Mining’s current mineral resource has an effective date of October 15, 2024. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Additional information, including with respect to key assumptions, parameters, and methods used to estimate mineral resources, is available in Prime Mining’s amended and restated technical report (the “Prime Mining Technical Report”) entitled “The Los Reyes Project, México” with a report date of June 27, 2025 and an effective date of October 15, 2024, a copy of which is available under Prime Mining’s profile on SEDAR+ at www.sedarplus.ca.

The broader land package remains underexplored with drilling to date primarily focused on the Guadalupe, Zapote-Tahonitas (Z-T), and Central trends. Significant exploration potential exists beyond the known trends including generative targets across the broader land package.

Work is underway to complete a preliminary economic assessment for Los Reyes by mid-2026. The study will evaluate various scenarios for mine development, including assessing economics for both open pit and underground operations, with a view to maximizing margins and mine life.

-

Notes

Prime Mining’s current mineral resource has an effective date of October 15, 2024. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Additional information, including with respect to key assumptions, parameters, and methods used to estimate mineral resources, is available in Prime Mining’s amended and restated technical report (the “Prime Mining Technical Report”) entitled “The Los Reyes Project, México” with a report date of June 27, 2025 and an effective date of October 15, 2024, a copy of which is available under Prime Mining’s profile on SEDAR+ at www.sedarplus.ca.

Notes to mineral resource table:

- Open Pit Resource estimates are based on economically constrained open pits generated using the Hochbaum Pseudoflow algorithm in Datamine’s Studio NPVS and the following optimization parameters (all dollar values are in US dollars):

- $1,950/ounce gold price and $25.24/ounce silver price.

- Mill recoveries of 95.6% and 81% for gold and silver, respectively.

- Heap leach recoveries of 73% and 25% for gold and silver, respectively.

- Pit slopes by area ranging from 42-47 degrees overall slope angle.

- 5% ore loss and 5% dilution factor applied to the 5 x 5 x 5m open pit resource block models.

- Mining costs of $2.00 per tonne of waste mined and $2.50 per tonne of ore mined.

- Milling costs of $16.81 per tonne processed.

- Heap Leach costs of $5.53 per tonne processed.

- G&A cost of $2.00 per tonne of material processed.

- 3% royalty costs and 1% selling costs were also applied.

- A 0.17 g/t gold only cutoff was applied to ex-pit processed material (which is above the heap-leaching NSR cutoff).

- Underground Resource estimates are based on economically constrained stopes generated using Datamine’s Mineable Shape Optimizer (MSO) algorithm and the following optimization parameters (all dollar values are in US dollars):

- $1,950/ounce gold price and $25.24/ounce silver price.

- Mill recoveries of 95.6% and 81% for gold and silver, respectively.

- Mechanized cut and fill mining with a $60.00 per tonne cost.

- Diluted to a minimum 4m stope width with a 98% mining recovery.

- G&A cost of $4.00 per tonne of material processed.

- Milling costs of $16.81 per tonne processed.

- 3% royalty costs and 1% selling costs were also applied.

- Mineral Resources are not Mineral Reserves (as that term is defined in the CIM Definition Standards) and do not have demonstrated economic viability.

- Open Pit Resource estimates are based on economically constrained open pits generated using the Hochbaum Pseudoflow algorithm in Datamine’s Studio NPVS and the following optimization parameters (all dollar values are in US dollars):