News

Torex Gold Reports Excellent Drilling Results from EPO

July 16, 2025

Outstanding high-grade intercepts indicate strong potential to continue to expand resources to the north of the deposit

(All amounts expressed in U.S. dollars unless otherwise stated)

Toronto, Ontario--(Newsfile Corp. - July 16, 2025) - Torex Gold Resources Inc. (the "Company" or "Torex") (TSX: TXG) announces assay results from the Company's ongoing drilling program in the northern extension of EPO. The results to date support the Company's goal of expanding resources to the north of the EPO deposit, which, in conjunction with drilling within the ELG and Media Luna clusters, is aimed at enhancing and extending the current production profile of the Morelos Complex beyond 2035. Results contained in this news release include notable highlights from drilling at EPO that were included in the year-end 2024 mineral reserve and resource update, as well as drilling results from this year's program through May 15, 2025.

Jody Kuzenko, President & CEO of Torex, stated:

"We continue to be impressed with the significant exploration potential at EPO, our newest mine development on the Morelos Property. The strong drilling results we are seeing in the northern portion of EPO build on the success we had in that area in 2024 when we added more than 233,000 gold equivalent ounces ("oz AuEq") to Inferred Resources.

"The most recent drill results include several impressive intercepts including a remarkable 55.18 grams per tonne ("gpt") AuEq over 20.1 metres ("m") in ML24-1049DA as well as 4.92 gpt AuEq over 35.7 m and 8.98 gpt over 20.1 m in drill hole ML24-1042. To date, mineralization encountered in the northern portion of EPO extends over an extensive area of at least 500 x 200 m, with vertical continuity of over 100 m.

"These latest drilling results at EPO, along with results released earlier this year at ELG Underground, Media Luna East, and Media Luna West, underline the prolific nature of the Morelos Property and our potential to continue to enhance and extend the reserve case production profile released in September 2024. With the first blast taken to access the EPO deposit from the Guajes Tunnel in late May, we remain on track to deliver first production from EPO by the end of 2026, which firmly establishes a minimum of at least 450,000 oz AuEq produced annually through 2030 and likely well beyond that as we continue to unlock the full potential of Morelos through drilling and exploration."

HIGHLIGHTS

- The 2024 EPO drilling program successfully added approximately 233,000 oz AuEq of Inferred Resources, primarily from exploration success in the northern area of the deposit.(i) The most notable intercepts encountered in this area that were included in the 2024 year-end resource update include ML24-1041 (5.65 gpt AuEq over 10.1 m, 4.55 gpt AuEq over 15.0 m, and 6.34 gpt AuEq over 14.6 m) and ML24-1042 (4.92 gpt AuEq over 35.7 m, 8.98 gpt AuEq over 20.1 m, and 4.70 gpt AuEq over 7.6 m). These results added new resources at EPO's northern extension and defined the focus area for follow-up drilling in this year's program.

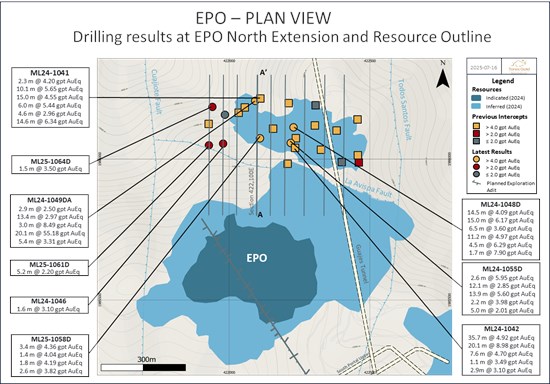

- Drilling from this year's program in the northern area of EPO has continued to return strong results, particularly drill hole ML24-1049DA which returned notable intercepts of 55.18 gpt AuEq over 20.1 m and 2.97 gpt AuEq over 13.4 m. This hole was a follow-up of drill hole ML24-1041 over a north-south section and confirmed a mineralized vertical column of at least 100 m (Figure 2). These intercepts indicate strong potential to expand resources in the north of the deposit and upgrade Inferred Resources to the Indicated Resources category with the year-end 2025 mineral reserve and resource update.

- The follow-up of drill hole ML24-1042 over a north-south section located 120 m to the east of drill hole ML24-1049DA also returned multiple mineralized intercepts, notably 6.17 gpt AuEq over 15.0 m, 4.97 gpt AuEq over 11.2 m, and 4.09 gpt AuEq over 14.5 m in ML24-1048D, and 2.85 gpt AuEq over 12.1 m and 5.60 gpt AuEq over 13.9 m in ML24-1055D. These results indicate that mineralization extends to the north, further supporting an expected increase in resources at EPO.

(i) For additional information on EPO resources, please refer to Table 2 of this news release.

EPO DRILLING PROGRAM

Drilling at EPO remains a key focus as the Company aims to expand mineral resources to the north (Figure 1) and upgrade Inferred Resources to Indicated Resources, with an ultimate target of enhancing the production profile and economics outlined in the internal EPO pre-feasibility study released in September 2024.(i) The drilling program to the north of EPO has confirmed the vertical continuity of the mineralization with outstanding high-grade intercepts that could open new mining fronts, if proven to be economic and brought into future reserves.

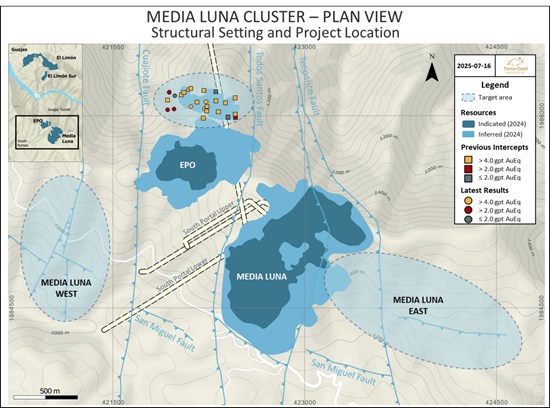

Figure 1: Plan view of the Media Luna Cluster which includes EPO

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1863/259009_05e820d574699958_001full.jpg

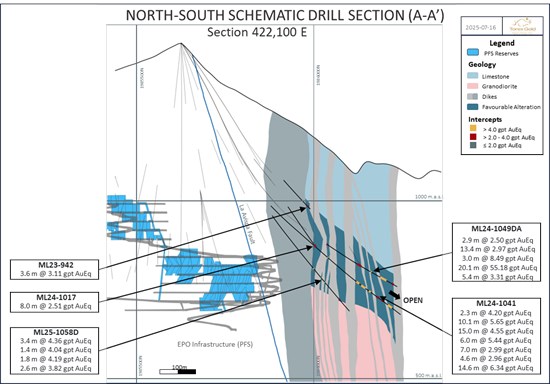

Having defined the main mineralization control following a west-northwest trend, drilling is being conducted along north-south sections using a fan arrangement of directional holes to have a better understanding of the mineralized zones to support the geological interpretation.

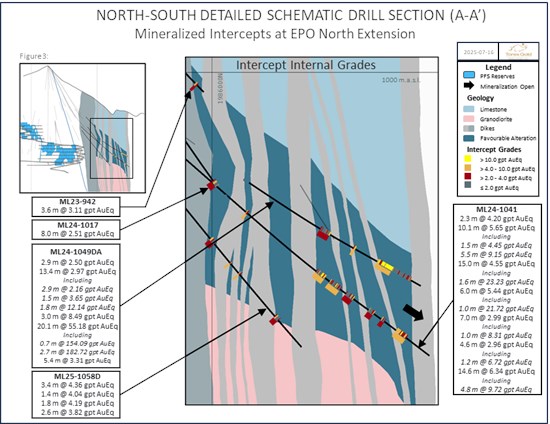

Drilling in the northern area of EPO to date in 2025 has been focused on the northern block of the west-northwest La Avispa fault (Figure 2), which controls a dike swarm of an estimated width of 150 to 200 m that represents a discontinuity between the main EPO mineralized zone to the south and its northern extension within the hanging wall of the fault. Mineralization at the southern end of the La Avispa fault is controlled by the contact between the limestones and the intrusive bodies that host most of the mineralization at the Media Luna Cluster, while, at its northern extension, most of the mineralization is bound by the pre-mineral west-northwest dikes that intruded through the same structures as the mineralization feeders in this area (Figures 3 and 4).

The current mineralization footprint in the north extends approximately 500 x 200 m with a west-northwest strike that has a significant vertical continuity ranging between 15 m to over 100 m between the interpreted boundaries of the favourable alteration zone that vertically extends for ~200 m. The lateral continuity of the mineralization is defined by the spacing between the dikes that varies from approximately 5 to 35 m, defining several mineralized blocks. Mineralization remains open to the north following the favourable alteration zone.

(i) For more information related to the EPO pre-feasibility study results, please refer to press release dated September 4, 2024 titled: Torex Gold Integrates EPO Deposit into Morelos Mine Plan.

Drill hole ML24-1041 (Figure 3 and 4) suggests a continuity at depth of the mineralization for up to 50 m towards the contact between the Morelos Formation limestones and the underlying granodiorite. The vertical continuity of the high-grade mineralization intercepted by drill hole ML24-1049DA at shallower elevations will be defined through follow-up drilling later this year.

The positive initial results of the drilling program support the potential to upgrade Inferred Resources to Indicated Resources with the year-end 2025 mineral reserve and resource update.

Table 1: Highlights from the advanced exploration drilling program in the northern extension of EPO

| Drill Hole | From (m) |

To (m) |

Core Length (m) |

Au (gpt) |

Ag (gpt) |

Cu (%) |

AuEq (gpt) |

| ML24-1046 | 672.9 | 674.5 | 1.6 | 0.47 | 49.3 | 1.21 | 3.10 |

| ML24-1048D | 713.2 | 727.7 | 14.5 | 1.08 | 48.7 | 1.44 | 4.09 |

| including | 720.1 | 727.7 | 7.6 | 0.99 | 71.6 | 2.28 | 5.67 |

| 737.0 | 752.0 | 15.0 | 0.51 | 88.9 | 2.74 | 6.17 | |

| including | 739.5 | 740.9 | 1.4 | 0.67 | 184.2 | 5.71 | 12.48 |

| including | 745.1 | 747.6 | 2.5 | 1.05 | 144.1 | 4.47 | 10.29 |

| 784.7 | 791.1 | 6.5 | 2.86 | 79.2 | 1.78 | 3.60 | |

| including | 786.3 | 786.9 | 0.6 | 17.50 | 222.4 | 4.99 | 28.61 |

| 798.7 | 809.8 | 11.2 | 0.63 | 97.5 | 1.87 | 4.97 | |

| 839.1 | 843.6 | 4.5 | 0.44 | 115.0 | 2.64 | 6.29 | |

| 901.7 | 903.4 | 1.7 | 0.96 | 83.7 | 3.55 | 7.90 | |

| ML24-1049DA | 711.9 | 714.8 | 2.9 | 2.25 | 16.2 | 0.02 | 2.50 |

| 815.1 | 828.5 | 13.4 | 2.47 | 8.4 | 0.24 | 2.97 | |

| including | 815.1 | 818.0 | 2.9 | 1.25 | 11.0 | 0.47 | 2.16 |

| including | 822.4 | 823.9 | 1.5 | 3.22 | 8.1 | 0.20 | 3.65 |

| including | 826.7 | 828.5 | 1.8 | 11.69 | 16.4 | 0.15 | 12.14 |

| 858.5 | 861.4 | 3.0 | 7.37 | 18.3 | 0.54 | 8.49 | |

| including | 860.5 | 861.4 | 1.0 | 13.60 | 43.0 | 1.04 | 15.88 |

| 889.9 | 910.0 | 20.1 | 45.87 | 96.6 | 4.89 | 55.18 | |

| including | 896.9 | 897.6 | 0.7 | 148.90 | 67.5 | 2.62 | 154.09 |

| including | 901.0 | 903.7 | 2.7 | 175.54 | 88.0 | 3.66 | 182.72 |

| 928.0 | 933.4 | 5.4 | 0.60 | 34.3 | 1.38 | 3.31 | |

| ML24-1055D | 725.4 | 728.1 | 2.6 | 0.49 | 91.2 | 2.59 | 5.95 |

| 733.4 | 745.5 | 12.1 | 0.28 | 44.9 | 1.20 | 2.85 | |

| including | 733.4 | 734.9 | 1.6 | 0.54 | 80.2 | 2.14 | 5.11 |

| including | 736.4 | 739.4 | 3.0 | 0.28 | 57.5 | 1.79 | 3.96 |

| including | 744.1 | 745.5 | 1.4 | 0.64 | 84.0 | 1.67 | 4.49 |

| 752.1 | 766.1 | 13.9 | 1.34 | 67.6 | 2.05 | 5.60 | |

| including | 758.7 | 766.1 | 7.3 | 2.16 | 99.0 | 3.21 | 8.74 |

| 781.6 | 782.8 | 1.3 | 0.44 | 66.7 | 2.25 | 5.02 | |

| 818.3 | 820.5 | 2.2 | 0.39 | 59.0 | 1.71 | 3.98 | |

| 871.0 | 876.0 | 5.0 | 1.06 | 4.3 | 0.54 | 2.01 | |

| ML25-1058D | 740.7 | 744.0 | 3.4 | 1.84 | 35.5 | 1.25 | 4.36 |

| 775.8 | 777.2 | 1.4 | 2.73 | 14.6 | 0.68 | 4.04 | |

| 791.6 | 793.5 | 1.8 | 0.41 | 52.3 | 1.88 | 4.19 | |

| 855.4 | 857.9 | 2.6 | 0.97 | 31.0 | 1.49 | 3.82 | |

| ML25-1061D | 724.4 | 729.6 | 5.2 | 1.16 | 10.8 | 0.55 | 2.20 |

| including | 728.8 | 729.6 | 0.9 | 0.21 | 28.1 | 1.49 | 3.03 |

| ML25-1064D | 829.2 | 830.7 | 1.5 | 0.80 | 48.0 | 1.26 | 3.50 |

Notes to Table:

1) Drill hole intercepts are core length. True width/thickness will be determined once the geological modelling is completed.

2) Core lengths reflect drilling core recovery of 89.1-100% and are subject to rounding. Assay results are uncapped.

3) Coordinates are WGS 1984 UTM Zone 14N.

4) The gold equivalent grade calculation used is as follows: AuEq = Au (gpt) + (Ag (gpt) * 0.0130) + (Cu (%) * 1.6480) and use the same metal prices ($1,650/oz Au, $22/oz Ag, and $3.75/lb Cu) and metallurgical recoveries (87% Au, 85% Ag, and 92% Cu) used in the year-end 2024 mineral resource estimate for EPO Underground.

Torex has budgeted approximately $10 million towards drilling at EPO, $5 million of which is related to drilling and exploration within the northern extension of EPO. Drilling is progressing with four rigs in the area. The Company is on track to achieve the planned 12,000 m of drilling specific to the northern extension of EPO by the end of the year, with 9,430 m completed by mid-May over 12 drill holes. This supports the overall program of 27,000 m at EPO planned for 2025.

Drill results, including those that have been previously reported, can be found in Tables 3 through 8. AuEq grades use the same metal prices ($1,650/oz gold ("Au"), $22/oz silver ("Ag"), and $3.75/lb copper ("Cu")) and metallurgical recoveries (87% Au, 85% Ag, and 92% Cu) used in the current mineral resource estimate for EPO Underground (effective date of December 31, 2024) and has been applied to the assay results for newly published drill holes as well as previously published drill holes. The gold equivalent grade calculation used is as follows: AuEq = Au (gpt) + (Ag (gpt) * 0.0130) + (Cu (%) * 1.6480).

EPO GEOLOGY

The main host unit at EPO is the Morelos Formation, cut by an intrusive phase of the Media Luna granodiorite and followed by multiple generations of late felsic dikes predominantly oriented northwest and northeast. A dome and phreatomagmatic breccia event with an apparent north-south control crosscuts the whole sequence.

EPO is located to the east of the major Cuajiote fault within a structural block characterized by multiple second-order structures. These structures are recognized at surface and in drill core, and exhibit north-south, north-northeast, and west-northwest orientations. The north-south oriented Copalillo and Todos Santos bound the main alteration-mineralization event. The EPO northern extension is located to the north of the west-northwest La Avispa fault controlling a dike swarm of an estimated width of 150 to 200 m that represents a discontinuity of the mineralization towards the main mineralized body to the south of the fault. Mineralization at the south of the La Avispa fault is controlled by the contact between the limestones and the intrusive bodies that host most of the mineralization at the Media Luna Cluster, while, at its northern extension most of the mineralization is bounded by the west-northwest dikes that represent the mineralization feeders in this area. Early-stage calc-silicate alteration is related to a proximal "aborted" skarn event containing anomalous molybdenum values and traces of Cu and Au. The latter grades into CRD-style mineralization that is associated with the main Cu and Ag mineralization event. Mineralizing fluids are believed to have originated from a deeper magmatic source, younger than the Media Luna granodiorite stocks, which have not yet been identified at surface. A late intermediate sulphidation-epithermal mineralization event, related to the phreatomagmatic activity, increases the Au volume and grade. Dikes and sills are deemed to have been previously emplaced along the same feeder structures of the mineralization event and constitute traps for the mineralized bodies. Given that Au precipitates due to the buffer exerted by the early stage calc-silicate alteration and sulfide mineralization, it occurs as free Au and is dissociated from the early Cu event mainly related to chalcopyrite.

QA/QC AND QUALIFIED PERSON

Torex maintains an industry-standard analytical quality assurance and quality control ("QA/QC") and data verification program to monitor laboratory performance. Results from this program confirm the reliability of the assay results.

The exploration program and analytical QA/QC program for Media Luna Cluster drilling is currently overseen by José Antonio San Vicente Díaz, Chief Exploration Geologist for Minera Media Luna, S.A. de C.V. All samples reported have been checked against Company and Lab standards and blanks. No core duplicate samples are taken.

HQ-size core is sawn in half with half the core retained in the core box and the other half bagged and tagged for shipment to the sample preparation facility. Sample preparation is carried out by Bureau Veritas ("BV"), an accredited laboratory, at its facilities in Durango, Mexico and consists of crushing a 1 kg sample to >70% passing 2 mm followed by pulverization of 500 g to >85% passing 75 μm. Au is analyzed at the BV facilities in Hermosillo, Mexico following internal analytical protocols (FA430) and comprises a 30 g fire assay with an atomic absorption finish. Samples yielding results >10 g/t Au are re-assayed by fire assay with gravimetric finish (FA530). Cu and Ag analyses are completed at the BV facilities in Vancouver, Canada as part of a multi-element geochemical analysis by an aqua regia digestion and/or four acid digestion with detection by ICPES/MS using BV internal analytical protocol AQ270/AQ370. Overlimits for the multi-element package are analyzed by internal protocol AQ374. Approximately 5% of the samples collected from exploration are sent for analyses checks and assayed for Au, Ag, and Cu. External pulp check assays for QA/QC purposes are performed at ALS Chemex, de Mexico S.A. de C.V., an accredited laboratory.

Internal and external check control results are reviewed daily by MML database team, and an external audit by GeoSoporte Mexico is carried out monthly. The pulp check samples are analysed for Au, Ag and Cu. Overall comparability between Bureau Veritas and ALS Chemex is good to excellent, with high correlation.

Scientific and technical information contained in this news release, other than the expected commencement of mining at EPO and the estimated annual production for the Morelos property, has been reviewed and approved by Rochelle Collins, P.Geo. (PGO #1412), Principal, Mineral Resource Geologist with Torex Gold Resources Inc. a "qualified person" ("QP") as defined by NI 43-101. Ms. Collins has verified the information disclosed, including sampling, analytical, and test data underlying the drill results. Verification included visually reviewing the drill holes in three dimensions, comparing the assay results to the original assay certificates, reviewing the drilling database, and reviewing core photography consistent with standard practice. Ms. Collins consents to the inclusion in this release of said information in the form and context in which they appear.

Scientific and technical information contained in this news release regarding the expected commencement of mining at EPO and the estimated annual production for the Morelos property, has been reviewed and approved by Dave Stefanuto, P. Eng, Executive Vice President, Technical Services and Capital Projects of Torex Gold Resources Inc. and a QP.

Additional information on sampling and analyses, analytical labs, and methods used for data verification is available in the Company's technical report entitled the "Morelos Property, NI 43-101 Technical Report, ELG Mine Complex Life of Mine Plan and Media Luna Feasibility Study, Guerrero State, Mexico", dated effective March 16, 2022 filed on March 31, 2022 (the "2022 Technical Report") and in the annual information form ("AIF") dated March 21, 2025, each filed on SEDAR+ at www.sedarplus.ca and the Company's website at www.torexgold.com. Additional information on the EPO mineral resource estimate can also be found in the AIF.

ABOUT TOREX GOLD RESOURCES INC.

Torex Gold Resources Inc. is an intermediate gold producer based in Canada, engaged in the exploration, development, and operation of its 100% owned Morelos Property, an area of 29,000 hectares in the highly prospective Guerrero Gold Belt located 180 kilometres southwest of Mexico City.

The Company's principal asset is the Morelos Complex, which includes the producing Media Luna Underground, ELG Underground, and ELG Open Pit mines, the development stage EPO Underground Project, a processing plant, and related infrastructure. Commercial production from the Morelos Complex commenced on April 1, 2016 and an updated Technical Report for the Morelos Complex was released in March 2022.

Torex's key strategic objectives are: deliver Media Luna to full production and build EPO; optimize Morelos production and costs; grow reserves and resources; disciplined growth and capital allocation; retain and attract best industry talent; and industry leader in responsible mining. In addition to realizing the full potential of the Morelos Property, the Company is seeking opportunities to acquire assets that enable diversification and deliver value to shareholders.

FOR FURTHER INFORMATION, PLEASE CONTACT:

TOREX GOLD RESOURCES INC.

Jody Kuzenko

President and CEO

Direct: (647) 725-9982

moc.dlogxerot@oknezuk.ydoj

Dan Rollins

Senior Vice President, Corporate Development & Investor Relations

Direct: (647) 260-1503

moc.dlogxerot@snillor.nad

CAUTIONARY NOTES ON FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking statements" and "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information also includes, but is not limited to, statements about: outstanding high-grade intercepts indicate strong potential to continue to expand resources to the north of the deposit; the results to date support the Company's goal of expanding resources to the north of the EPO deposit, which, in conjunction with drilling within the ELG and Media Luna clusters, is aimed at enhancing and extending the current production profile of the Morelos Complex beyond 2035; these latest drilling results at EPO, along with results released earlier this year at ELG Underground, Media Luna East, and Media Luna West, underline the prolific nature of the Morelos Property and our potential to continue to enhance and extend the reserve case production profile released in September 2024; the Company remains on track to deliver first production from EPO by the end of 2026, which firmly establishes a minimum of at least 450,000 oz AuEq produced annually through 2030 and likely well beyond; drilling results in the northern area of EPO indicate strong potential to expand resources in the north of the deposit and upgrade Inferred Resources to the Indicated Resources category with the year-end 2025 mineral reserve and resource update; results from drill hole ML24-1042 over a north-south section located 120 m to the east of drill hole ML24-1049DA indicate that mineralization extends to the north, further supporting an expected increase in resources at EPO; the drilling program to the north of EPO has confirmed the vertical continuity of the mineralization with outstanding high-grade intercepts that could open new operating fronts, if proven to be economic and brought into future reserves; results of drill hole ML24-1041 suggests a continuity at depth of the mineralization for up to 50 m towards the contact between the Morelos Formation limestones and the underlying granodiorite; Torex has budgeted approximately $10 million towards drilling at EPO, $5 million of which is related to drilling and exploration within the northern extension of EPO; the Company is on track to achieve the planned 12,000 m of drilling specific to the northern extension of EPO by the end of the year, with 9,430 m completed by mid-May over 12 drill holes; this supports the overall program of 27,000 m at EPO planned for 2025; and; and Torex's key strategic objectives are to optimize and extend production from the ELG Mine Complex, de-risk and advance Media Luna to commercial production, build on ESG excellence, and to grow through ongoing exploration across the entire Morelos Property. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "objective", "strategy", "target", "continue", "potential", "focus", "aim" or variations of such words and phrases or statements that certain actions, events or results "will", "would", or "is expected to" occur. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including, without limitation, risks and uncertainties associated with: the ability to upgrade mineral resources to categories of mineral resources with greater confidence levels or to mineral reserves; risks associated with mineral reserve and mineral resource estimation; uncertainty involving skarn deposits; and those risk factors identified in the Technical Report and the Company's annual information form and management's discussion and analysis or other unknown but potentially significant impacts. Forward-looking information is based on the assumptions discussed in the Technical Report and such other reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances at the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information, there may be other factors that cause results not to be as anticipated. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, whether as a result of new information or future events or otherwise, except as may be required by applicable securities laws. The Technical Report, AIF and MD&A are filed on SEDAR+ at www.sedarplus.ca and the Company's website at www.torexgold.com.

Table 2: Mineral Resource Estimate - EPO Underground (December 31, 2024)

| Tonnes | Au | Ag | Cu | Au | Ag | Cu | AuEq | AuEq | |

| (kt) | (gpt) | (gpt) | (%) | (koz) | (koz) | (Mlb) | (gpt) | (koz) | |

| EPO Underground | |||||||||

| Measured | - | - | - | - | - | - | - | - | - |

| Indicated | 7,060 | 2.66 | 31.2 | 1.28 | 604 | 7,082 | 200 | 5.18 | 1,176 |

| Measured & Indicated | 7,060 | 2.66 | 31.2 | 1.28 | 604 | 7,082 | 200 | 5.18 | 1,176 |

| Inferred | 6,883 | 1.76 | 39.3 | 1.24 | 390 | 8,690 | 188 | 4.31 | 954 |

Notes to accompany the mineral resource table:

1. Mineral resources were prepared in accordance with the CIM Definition Standards (May 2014).

2. The effective date of the estimates is December 31, 2024.

3. Mineral resources are depleted above a mining surface or to the as-mined solids as of December 31, 2024.

4. Gold equivalent ("AuEq") of total mineral resources is established from combined contributions of the various deposits.

5. Mineral resources for all deposits are based on an underlying gold ("Au") price of $1,650/oz, silver ("Ag") price of $22/oz, and copper ("Cu") price of $3.75/lb.

6. Mineral resources are inclusive of mineral reserves (ex-stockpiles). Mineral resources that are not mineral reserves do not have demonstrated economic viability.

7. Numbers may not add due to rounding.

8. Mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

9. The estimate was prepared by Mrs. Rochelle Collins, P.Geo. (Ontario), Principal, Mineral Resources.

Notes to accompany EPO Underground mineral resources:

1. Mineral resources for EPO Underground are reported above a 2.0 gpt AuEq cut-off grade. The assumed mining method is from underground methods, using long-hole open stoping.

2. Mineral resources were estimated using ID3 methods applied to 1.0 m capped downhole assay composites within lithology domains and internal grade domains. Block model size is 5 m x 5 m x 5m with 2.5 m x 2.5 m x 2.5 m sub-blocks.

3. Metallurgical recoveries at EPO average 87% Au, 85% Ag, and 92% Cu.

4. The dataset allowed the bulk density to be directly estimated into the domains with an average bulk density of 3.5 g/cm3.

5. EPO Underground AuEq = Au (gpt) + (Ag (gpt) * 0.0130) + (Cu (%) * 1.6480), accounting for underlying metal prices and metallurgical recoveries.

Figure 2: Drilling results from the northern extension of EPO showing the proximity to the La Avispa fault.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1863/259009_05e820d574699958_002full.jpg

Figure 3: Drilling results from EPO that lay at the northern block of the west-northwest La Avispa fault showing most of the mineralization is found between the west-northwest dikes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1863/259009_05e820d574699958_003full.jpg

Figure 4: Detailed internal grades of mineralized intercepts at EPO that lay at the northern block of the west-northwest La Avispa fault showing that most of the mineralization is found between the west-northwest dikes with open vertical and along strike continuity.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1863/259009_05e820d574699958_004full.jpg

Table 3: Drilling results from the late 2024 and 2025 year-to-date exploration and drilling program in the northern area of EPO.

| Intercept | |||||||||||||||

| Drill Hole | Program | UTM-E (m) | UTM-N (m) | Elevation (m) | Azimuth (°) | Dip (°) | Final Depth (m) | From (m) |

To (m) |

Core Length (m) |

Au (gpt) |

Ag (gpt) |

Cu (%) |

AuEq (gpt) |

Core Recovery (%) |

| ML24-1046 | Del. | 421983.6 | 1985609.8 | 1440.5 | 359 | -48 | 957 | 672.9 | 674.5 | 1.6 | 0.47 | 49.3 | 1.21 | 3.10 | 100.0% |

| ML24-1048D | Del. | 422198.7 | 1985619.7 | 1460.6 | 3 | -55 | 929 | 713.2 | 727.7 | 14.5 | 1.08 | 48.7 | 1.44 | 4.09 | 100.0% |

| including | 720.1 | 727.7 | 7.6 | 0.99 | 71.6 | 2.28 | 5.67 | 100.0% | |||||||

| 737.0 | 752.0 | 15.0 | 0.51 | 88.9 | 2.74 | 6.17 | 100.0% | ||||||||

| including | 739.5 | 740.9 | 1.4 | 0.67 | 184.2 | 5.71 | 12.48 | 100.0% | |||||||

| including | 745.1 | 747.6 | 2.5 | 1.05 | 144.1 | 4.47 | 10.29 | 100.0% | |||||||

| 784.7 | 791.1 | 6.5 | 2.86 | 79.2 | 1.78 | 3.60 | 99.9% | ||||||||

| including | 786.3 | 786.9 | 0.6 | 17.50 | 222.4 | 4.99 | 28.61 | 99.9% | |||||||

| 798.7 | 809.8 | 11.2 | 0.63 | 97.5 | 1.87 | 4.97 | 100.0% | ||||||||

| 839.1 | 843.6 | 4.5 | 0.44 | 115.0 | 2.64 | 6.29 | 100.0% | ||||||||

| 901.7 | 903.4 | 1.7 | 0.96 | 83.7 | 3.55 | 7.90 | 100.0% | ||||||||

| ML24-1049D | Del. | 422101.2 | 1985627.1 | 1447.1 | 360 | -60 | 540 | No significant values | |||||||

| ML24-1049DA | Del. | 422101.2 | 1985627.1 | 1447.1 | 360 | -60 | 945 | 711.9 | 714.8 | 2.9 | 2.25 | 16.2 | 0.02 | 2.50 | 100.0% |

| 815.1 | 828.5 | 13.4 | 2.47 | 8.4 | 0.24 | 2.97 | 100.0% | ||||||||

| including | 815.1 | 818.0 | 2.9 | 1.25 | 11.0 | 0.47 | 2.16 | 100.0% | |||||||

| including | 822.4 | 823.9 | 1.5 | 3.22 | 8.1 | 0.20 | 3.65 | 100.0% | |||||||

| including | 826.7 | 828.5 | 1.8 | 11.69 | 16.4 | 0.15 | 12.14 | 100.0% | |||||||

| 858.5 | 861.4 | 3.0 | 7.37 | 18.3 | 0.54 | 8.49 | 100.0% | ||||||||

| including | 860.5 | 861.4 | 1.0 | 13.60 | 43.0 | 1.04 | 15.88 | 100.0% | |||||||

| 889.9 | 910.0 | 20.1 | 45.87 | 96.6 | 4.89 | 55.18 | 95.9% | ||||||||

| including | 896.9 | 897.6 | 0.7 | 148.90 | 67.5 | 2.62 | 154.09 | 100.0% | |||||||

| including | 901.0 | 903.7 | 2.7 | 175.54 | 88.0 | 3.66 | 182.72 | 100.0% | |||||||

| 928.0 | 933.4 | 5.4 | 0.60 | 34.3 | 1.38 | 3.31 | 100.0% | ||||||||

| ML24-1053D | Del. | 421983.6 | 1985609.8 | 1440.5 | 359 | -48 | 1014 | No significant values | |||||||

Notes to Table

1) Drill hole intercepts are core length. True width/thickness will be determined once the geological modelling is completed.

2) The gold equivalent grade calculation used is as follows: AuEq = Au (gpt) + (Ag (gpt) * 0.0130) + (Cu (%) * 1.6480) and use the same metal prices ($1,650/oz Au, $22/oz Ag, and $3.75/lb Cu) and metallurgical recoveries (87% Au, 85% Ag, and 92% Cu) used in the year-end 2024 mineral resource estimate for EPO Underground.

3) Core lengths subject to rounding. Assay results are uncapped.

4) Coordinates are WGS 1984 UTM Zone 14N.

5) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

Table 3 (continued): Drilling results from the late 2024 and 2025 year-to-date exploration and drilling program in the northern area of EPO.

| Intercept | |||||||||||||||

| Drill Hole | Program | UTM-E (m) | UTM-N (m) | Elevation (m) | Azimuth (°) | Dip (°) | Final Depth (m) | From (m) |

To (m) |

Core Length (m) |

Au (gpt) |

Ag (gpt) |

Cu (%) |

AuEq (gpt) |

Core Recovery (%) |

| ML24-1055D | Del. | 422198.7 | 1985619.7 | 1460.6 | 3 | -55 | 938 | 725.4 | 728.1 | 2.6 | 0.49 | 91.2 | 2.59 | 5.95 | 100.0% |

| 733.4 | 745.5 | 12.1 | 0.28 | 44.9 | 1.20 | 2.85 | 100.0% | ||||||||

| including | 733.4 | 734.9 | 1.6 | 0.54 | 80.2 | 2.14 | 5.11 | 100.0% | |||||||

| including | 736.4 | 739.4 | 3.0 | 0.28 | 57.5 | 1.79 | 3.96 | 100.0% | |||||||

| including | 744.1 | 745.5 | 1.4 | 0.64 | 84.0 | 1.67 | 4.49 | 100.0% | |||||||

| 752.1 | 766.1 | 13.9 | 1.34 | 67.6 | 2.05 | 5.60 | 100.0% | ||||||||

| including | 758.7 | 766.1 | 7.3 | 2.16 | 99.0 | 3.21 | 8.74 | 100.0% | |||||||

| 781.6 | 782.8 | 1.3 | 0.44 | 66.7 | 2.25 | 5.02 | 100.0% | ||||||||

| 818.3 | 820.5 | 2.2 | 0.39 | 59.0 | 1.71 | 3.98 | 100.0% | ||||||||

| 871.0 | 876.0 | 5.0 | 1.06 | 4.3 | 0.54 | 2.01 | 100.0% | ||||||||

| ML24-1057 | Del. | 421928.7 | 1985579.6 | 1432.1 | 358 | -48 | 513 | No significant values | |||||||

| ML25-1058D | Del. | 422101.2 | 1985627.1 | 1447.1 | 360 | -60 | 1009 | 740.7 | 744.0 | 3.4 | 1.84 | 35.5 | 1.25 | 4.36 | 98.7% |

| 775.8 | 777.2 | 1.4 | 2.73 | 14.6 | 0.68 | 4.04 | 89.1% | ||||||||

| 791.6 | 793.5 | 1.8 | 0.41 | 52.3 | 1.88 | 4.19 | 100.0% | ||||||||

| 855.4 | 857.9 | 2.6 | 0.97 | 31.0 | 1.49 | 3.82 | 100.0% | ||||||||

| ML25-1061D | Del. | 421928.7 | 1985579.6 | 1432.1 | 358 | -48 | 841 | 724.4 | 729.6 | 5.2 | 1.16 | 10.8 | 0.55 | 2.20 | 100.0% |

| including | 728.8 | 729.6 | 0.9 | 0.21 | 28.1 | 1.49 | 3.03 | 100.0% | |||||||

| ML25-1064D | Del. | 421928.7 | 1985579.6 | 1432.1 | 358 | -48 | 945 | 829.2 | 830.7 | 1.5 | 0.80 | 48.0 | 1.26 | 3.50 | 100.0% |

| ML25-1067 | Del. | 422101.3 | 1985627.3 | 1447.5 | 0 | -53 | 411 | No significant values | |||||||

Notes to Table

1) Drill hole intercepts are core length. True width/thickness will be determined once the geological modelling is completed.

2) The gold equivalent grade calculation used is as follows: AuEq = Au (gpt) + (Ag (gpt) * 0.0130) + (Cu (%) * 1.6480) and use the same metal prices ($1,650/oz Au, $22/oz Ag, and $3.75/lb Cu) and metallurgical recoveries (87% Au, 85% Ag, and 92% Cu) used in the year-end 2024 mineral resource estimate for EPO Underground.

3) Core lengths subject to rounding. Assay results are uncapped.

4) Coordinates are WGS 1984 UTM Zone 14N.

5) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

Table 4: Drilling results included in the year-end 2024 mineral resource estimate but not previously reported.

| Intercept | |||||||||||||||

| Drill Hole | Program | UTM-E (m) | UTM-N (m) | Elevation (m) | Azimuth (°) | Dip (°) | Final Depth (m) | From (m) |

To (m) |

Core Length (m) |

Au (gpt) |

Ag (gpt) |

Cu (%) |

AuEq (gpt) |

Core Recovery (%) |

| ML24-1041 | Del. | 422101.2 | 1985627.1 | 1447.1 | 360 | -60 | 1006 | 742.2 | 744.5 | 2.3 | 3.80 | 11.6 | 0.15 | 4.20 | 100.0% |

| 849.0 | 859.1 | 10.1 | 4.24 | 28.4 | 0.63 | 5.65 | 95.3% | ||||||||

| including | 849.0 | 850.5 | 1.5 | 4.39 | 4.1 | 0.01 | 4.45 | 100.0% | |||||||

| including | 853.6 | 859.1 | 5.5 | 6.58 | 51.0 | 1.15 | 9.15 | 89.3% | |||||||

| 866.0 | 881.0 | 15.0 | 1.66 | 32.9 | 1.49 | 4.55 | 100.0% | ||||||||

| including | 873.7 | 875.2 | 1.6 | 9.64 | 157.7 | 7.01 | 23.23 | 100.0% | |||||||

| 893.4 | 899.4 | 6.0 | 5.02 | 7.9 | 0.19 | 5.44 | 100.0% | ||||||||

| including | 898.4 | 899.4 | 1.0 | 21.50 | 6.4 | 0.08 | 21.72 | 100.0% | |||||||

| 921.1 | 928.1 | 7.0 | 1.27 | 11.2 | 0.96 | 2.99 | 100.0% | ||||||||

| including | 927.1 | 928.1 | 1.0 | 5.78 | 19.9 | 1.38 | 8.31 | 100.0% | |||||||

| 938.7 | 943.3 | 4.6 | 1.23 | 13.6 | 0.94 | 2.96 | 100.0% | ||||||||

| including | 938.7 | 939.8 | 1.2 | 3.82 | 25.3 | 1.56 | 6.72 | 100.0% | |||||||

| 959.9 | 974.4 | 14.6 | 4.24 | 27.2 | 1.06 | 6.34 | 100.0% | ||||||||

| including | 962.9 | 967.7 | 4.8 | 5.88 | 47.8 | 1.95 | 9.72 | 100.0% | |||||||

| ML24-1042 | Del. | 422198.7 | 1985619.7 | 1460.6 | 3 | -55 | 947 | 711.0 | 746.6 | 35.7 | 0.94 | 65.6 | 1.90 | 4.92 | 100.0% |

| including | 725.5 | 728.4 | 2.9 | 2.03 | 163.7 | 5.99 | 14.04 | 100.0% | |||||||

| including | 731.2 | 746.6 | 15.4 | 0.85 | 84.2 | 2.40 | 5.90 | 100.0% | |||||||

| 755.3 | 775.4 | 20.1 | 1.91 | 114.9 | 3.38 | 8.98 | 100.0% | ||||||||

| including | 765.3 | 767.3 | 2.0 | 1.91 | 146.9 | 5.01 | 12.08 | 100.0% | |||||||

| including | 769.0 | 773.0 | 4.0 | 2.49 | 198.9 | 5.71 | 14.49 | 100.0% | |||||||

| 806.4 | 814.0 | 7.6 | 3.78 | 28.6 | 0.33 | 4.70 | 100.0% | ||||||||

| including | 810.1 | 810.7 | 0.5 | 19.50 | 27.3 | 0.00 | 19.86 | 100.0% | |||||||

| including | 813.0 | 814.0 | 1.0 | 11.50 | 37.6 | 0.65 | 13.06 | 100.0% | |||||||

| 863.9 | 865.0 | 1.1 | 0.31 | 45.4 | 1.57 | 3.49 | 100.0% | ||||||||

| 872.0 | 874.9 | 2.9 | 0.53 | 31.1 | 1.31 | 3.10 | 100.0% | ||||||||

Notes to Table

1) Drill hole intercepts are core length. True width/thickness will be determined once the geological modelling is completed.

2) The gold equivalent grade calculation used is as follows: AuEq = Au (gpt) + (Ag (gpt) * 0.0130) + (Cu (%) * 1.6480) and use the same metal prices ($1,650/oz Au, $22/oz Ag, and $3.75/lb Cu) and metallurgical recoveries (87% Au, 85% Ag, and 92% Cu) used in the year-end 2024 mineral resource estimate for EPO Underground.

3) Core lengths subject to rounding. Assay results are uncapped.

4) Coordinates are WGS 1984 UTM Zone 14N.

5) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

Table 5: Previously reported drilling results. For more information, please refer to the Company's press release titled "Torex Gold Reports Results from the Ongoing 2024 EPO Exploration Program" (November 13, 2024).

| Intercept | |||||||||||||||

| Drill Hole | Program | UTM-E (m) | UTM-N (m) | Elevation (m) | Azimuth (°) | Dip (°) | Final Depth (m) | From (m) |

To (m) |

Core Length (m) |

Au (gpt) |

Ag (gpt) |

Cu (%) |

AuEq (gpt) |

Core Recovery (%) |

| ML24-1017 | EPO | 421982.4 | 1985608.2 | 1440.4 | 17 | -54 | 958 | 699.5 | 707.5 | 8.0 | 1.47 | 21.6 | 0.46 | 2.51 | 100.0% |

| 721.0 | 722.7 | 1.7 | 3.43 | 23.5 | 0.17 | 4.02 | 100.0% | ||||||||

| 791.7 | 796.3 | 4.6 | 0.96 | 16.9 | 0.55 | 2.09 | 100.0% | ||||||||

| 847.1 | 859.3 | 12.2 | 1.07 | 33.7 | 1.16 | 3.43 | 100.0% | ||||||||

Notes to Table

1) Drill hole intercepts are core length. True width/thickness will be determined once the geological modelling is completed.

2) The gold equivalent grade calculation used is as follows: AuEq = Au (gpt) + (Ag (gpt) * 0.0130) + (Cu (%) * 1.6480) and use the same metal prices ($1,650/oz Au, $22/oz Ag, and $3.75/lb Cu) and metallurgical recoveries (87% Au, 85% Ag, and 92% Cu) used in the year-end 2024 mineral resource estimate for EPO Underground.

3) Core lengths subject to rounding. Assay results are uncapped.

4) Coordinates are WGS 1984 UTM Zone 14N.

5) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

Table 6: Previously reported drilling results. For more information, please refer to the Company's press release titled "Torex Reports Results From 2023 Drilling at EPO" (September 5, 2023).

| Intercept | |||||||||||||||

| Drill Hole | Program | UTM-E (m) | UTM-N (m) | Elevation (m) | Azimuth (°) | Dip (°) | Final Depth (m) | From (m) |

To (m) |

Core Length (m) |

Au (gpt) |

Ag (gpt) |

Cu (%) |

AuEq (gpt) |

Core Recovery (%) |

| ML23-942 | Adv. Ex. | 421981.6 | 1985607.0 | 1440.4 | 16 | -50 | 977 | 603.0 | 606.6 | 3.6 | 2.94 | 4.1 | 0.07 | 3.11 | 88.8% |

| 762.0 | 765.0 | 3.0 | 2.43 | 23.6 | 0.40 | 3.38 | 100.0% | ||||||||

| 791.9 | 807.7 | 15.8 | 3.26 | 58.9 | 1.36 | 6.27 | 100.0% | ||||||||

| including | 791.9 | 793.9 | 2.0 | 23.53 | 18.5 | 0.71 | 24.93 | 100.0% | |||||||

| 873.3 | 876.0 | 2.8 | 0.09 | 75.8 | 1.88 | 4.17 | 100.0% | ||||||||

| 912.5 | 923.7 | 11.2 | 1.54 | 27.1 | 1.35 | 4.12 | 100.0% | ||||||||

| including | 921.0 | 923.7 | 2.7 | 2.34 | 98.9 | 4.21 | 10.57 | 100.0% | |||||||

| ML23-949A | Adv. Ex. | 421983.8 | 1985606.6 | 1440.5 | 23 | -54 | 988 | 747.0 | 765.2 | 18.2 | 0.50 | 62.9 | 1.94 | 4.51 | 100.0% |

| including | 747.0 | 754.1 | 7.1 | 0.64 | 115.6 | 3.72 | 8.28 | 100.0% | |||||||

| 774.2 | 783.5 | 9.3 | 0.63 | 59.1 | 1.57 | 3.98 | 100.0% | ||||||||

| 791.0 | 794.0 | 3.1 | 3.64 | 30.4 | 0.75 | 5.27 | 100.0% | ||||||||

| 807.2 | 818.0 | 10.8 | 0.54 | 32.5 | 0.92 | 2.48 | 100.0% | ||||||||

| 834.8 | 841.0 | 6.2 | 2.52 | 100.1 | 3.18 | 9.05 | 100.0% | ||||||||

| 918.5 | 920.1 | 1.6 | 0.66 | 70.5 | 2.41 | 5.54 | 100.0% | ||||||||

Notes to Table

1) Drill hole intercepts are core length. True width/thickness will be determined once the geological modelling is completed.

2) The gold equivalent grade calculation used is as follows: AuEq = Au (gpt) + (Ag (gpt) * 0.0130) + (Cu (%) * 1.6480) and use the same metal prices ($1,650/oz Au, $22/oz Ag, and $3.75/lb Cu) and metallurgical recoveries (87% Au, 85% Ag, and 92% Cu) used in the year-end 2024 mineral resource estimate for EPO Underground.

3) Core lengths subject to rounding. Assay results are uncapped.

4) Coordinates are WGS 1984 UTM Zone 14N

5) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data

Table 7: Previously reported drilling results. For more information, please refer to the Company's press release titled "Torex Reports Encouraging Results From Drilling at EPO" (March 23, 2023).

| Intercept | |||||||||||||||

| Drill Hole | Program | UTM-E (m) | UTM-N (m) | Elevation (m) | Azimuth (°) | Dip (°) | Final Depth (m) | From (m) |

To (m) |

Core Length (m) |

Au (gpt) |

Ag (gpt) |

Cu (%) |

AuEq (gpt) |

Core Recovery (%) |

| ML22-857 | Adv. Ex. | 421981.6 | 1985603.8 | 1440.5 | 24 | -69 | 754 | 233.0 | 240.7 | 7.7 | 1.26 | 44.7 | 0.98 | 3.46 | 89.2% |

| 651.9 | 678.5 | 26.5 | 0.66 | 13.7 | 1.01 | 2.50 | 100.0% | ||||||||

| ML22-919D | Adv. Ex. | 422197.0 | 1985617.6 | 1461.0 | 307 | -77 | 726 | 648.0 | 694.7 | 46.7 | 3.10 | 12.4 | 0.68 | 4.38 | 99.6% |

| including | 665.3 | 668.3 | 3.0 | 13.53 | 61.8 | 2.34 | 18.19 | 100.0% | |||||||

| including | 676.7 | 678.7 | 2.0 | 4.57 | 23.7 | 0.90 | 6.36 | 90.0% | |||||||

| including | 685.2 | 688.6 | 3.5 | 13.09 | 10.7 | 0.67 | 14.33 | 100.0% | |||||||

| including | 692.3 | 694.7 | 2.4 | 10.23 | 28.4 | 1.63 | 13.29 | 100.0% | |||||||

Notes to Table

1) Drill hole intercepts are core length. True width/thickness will be determined once the geological modelling is completed.

2) The gold equivalent grade calculation used is as follows: AuEq = Au (gpt) + (Ag (gpt) * 0.0130) + (Cu (%) * 1.6480) and use the same metal prices ($1,650/oz Au, $22/oz Ag, and $3.75/lb Cu) and metallurgical recoveries (87% Au, 85% Ag, and 92% Cu) used in the year-end 2024 mineral resource estimate for EPO Underground.

3) Core lengths subject to rounding. Assay results are uncapped.

4) Coordinates are WGS 1984 UTM Zone 14N.

5) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

Table 8: Previously reported drilling results. For more information, please refer to the Company's press release titled "Torex Reports Assay Results of Step Out Drilling Program at Media Luna" (June 18, 2015).

| Intercept | |||||||||||||||

| Drill Hole | Program | UTM-E (m) | UTM-N (m) | Elevation (m) | Azimuth (°) | Dip (°) | Final Depth (m) | From (m) |

To (m) |

Core Length (m) |

Au (gpt) |

Ag (gpt) |

Cu (%) |

AuEq (gpt) |

Core Recovery (%) |

| NWZML-23 | Drill Test | 422364.6 | 1985817.2 | 1466.8 | 320 | -60 | 902 | 470.0 | 473.7 | 3.7 | 1.78 | 117.5 | 1.80 | 6.28 | 100.0% |

| 491.9 | 495.6 | 3.7 | 3.62 | 37.4 | 0.36 | 4.70 | 100.0% | ||||||||

| 764.8 | 778.3 | 13.5 | 3.19 | 9.1 | 0.27 | 3.75 | 100.0% | ||||||||

| including | 775.7 | 778.3 | 2.6 | 13.91 | 14.8 | 0.07 | 14.22 | 100.0% | |||||||

| 863.4 | 871.5 | 8.1 | 3.06 | 28.6 | 1.08 | 5.21 | 100.0% | ||||||||

| including | 863.4 | 868.1 | 4.7 | 4.44 | 26.0 | 1.49 | 7.23 | 100.0% | |||||||

Notes to Table

1) Drill hole intercepts are core length. True width/thickness will be determined once the geological modelling is completed.

2) The gold equivalent grade calculation used is as follows: AuEq = Au (gpt) + (Ag (gpt) * 0.0130) + (Cu (%) * 1.6480) and use the same metal prices ($1,650/oz Au, $22/oz Ag, and $3.75/lb Cu) and metallurgical recoveries (87% Au, 85% Ag, and 92% Cu) used in the year-end 2024 mineral resource estimate for EPO Underground.

3) Core lengths subject to rounding. Assay results are uncapped.

4) Coordinates are WGS 1984 UTM Zone 14N.

5) Torex is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/259009